- Home

- About

- Team

- About the President

- Mission

- Advisory bodies

- Associates

- Privacy Policy

- Terms and Conditions

- Pricing Policy

- Services

- Activities

- Events

- International Desk

- Sectors

- MSME

- Membership

- Publication

- Media

- Contact

Cost of microcredit set to decline in next five years

Cost of microcredit set to decline in next five years

“The Past models of microfinance companies were all brick and mortar based on branches and self help groups. The future could be disruptive with past success being no guarantee of future survival. Interest rate (for microcredit) is expected to fall to 15% in the next five years from the current level of over 20%,” remarked Mr. PSN Murthy, Assistant General Manager, Micro Units Development and Refinance Agency Ltd (MUDRA) while delivering keynote address at the event on ‘First in Series of ‘Make in India’ on Microfinance: A Game Changer for Financial Inclusion’ at World Trade Centre Complex, Mumbai on May 4, 2016. The event was jointly organised by All India Association of Industries (AIAI) and World Trade Centre Mumbai.

Mr. Murthy raised hope that the Indian microfinance industry is in the threshold of disruptive changes with the adoption of cutting edge information and communication technology. Soon, microfinance companies in India would graduate to the next stage where business is conducted without opening branches, which is witnessed in China, he added.

During the event, World Trade Centre Mumbai released a knowledge paper on ‘Impact of Microfinance in Financial Inclusion’.

Dr. Vidya Sravanthi, Managing Director, Asmitha Microfin Ltd agreed that increasing technology adoption would reduce the operational cost of microfinance companies and thereby enable them to cut lending rates. She also raised hope that the microfinance would be a great social movement to eradicate poverty in rural areas.

Mr. Sankar Chakraborti, CEO, SMERA Ratings Ltd remarked that the major challenge faced by the industry is high cost of distribution of loans as most of the microcredit borrowers are located in remote villages. However, there is scope for reduction in the cost because of digital banking, Mr. Chakraborti opined.

Ms. Meenal Patole, CEO & Managing Director, Agora Microfinance India Ltd pointed out that the biggest challenge for microfinance lenders is the availability of long term financial support from commercial banks and development finance institutions. “Financial institutions must offer long term financial support to microcredit companies as microfinance is a long gestation business which take years to generate profits,” Ms. Patole highlighted.

In order to create a greater impact on the society, Ms. Patole suggested that large financial institutions like SIDBI must work together with microfinance companies by creating district level forums.

Earlier in his welcome address, Mr. Vijay Kalantri, President, All India Association of Industries and Vice Chairman, World Trade Centre Mumbai remarked, “Patent protection and access to finance are related issues as companies that own patented products have greater ability to raise credit from financial institutions. The session would surely create awareness among MSMEs on the range of services offered by microfinance Companies”.

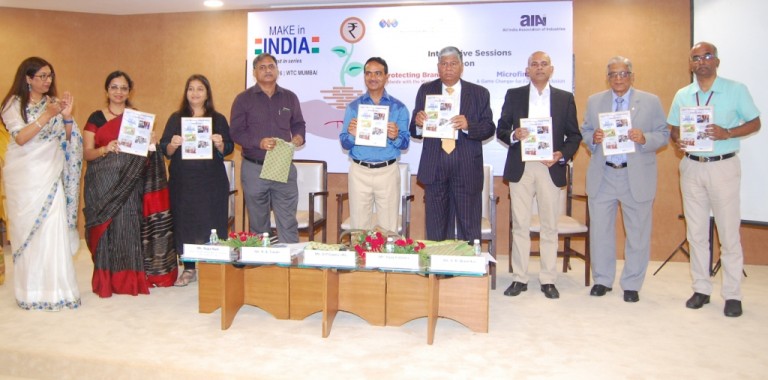

Captions: Distinguished speakers and chief guest releasing the knowledge paper on ‘Impact of Microfinance in Financial Inclusion’. From (L to R) Ms. Rupa Naik, Executive Director, All India Association of Industries (AIAI) and Director – Projects, World Trade Centre Mumbai, Dr. Vidya Sravanthi, Managing Director, Asmitha Microfin Ltd, Ms. Meenal Patole, CEO & Managing Director, Agora Microfinance India Ltd, Mr. R.A. Tiwari, Deputy Registrar of Trade Marks, Shri O.P. Gupta, IAS, Controller General of Patents, Designs & Trade Marks & Registrar of Geographical Indications, Mr. Vijay Kalantri, President, AIAI and Vice Chairman, World Trade Centre Mumbai, Mr. Sankar Chakraborti, CEO, SMERA Ratings Ltd, Mr. Y.R. Warerkar, Executive Director, World Trade Centre Mumbai, Mr. PSN Murthy, Assistant General Manager, Micro Units Development and Refinance Agency Ltd (MUDRA).

Recent Posts

Categories

- Agriculture

- Banking and finance

- Biotechnology

- Business Process Outsourcing

- Chemicals

- Defence

- Drugs & Pharmaceuticals

- Economic Affairs & Taxation

- Energy

- Engineering

- Exports & Imports

- Food Processing

- Food Processing

- ICTE Manufacturing

- Inbound delegation

- Information & Communication Technology

- Infrastructure

- Innovation

- Logistics

- Manufacturing

- Media & Entertainment

- Medium & Small Scale Industry

- Micro

- Oil and Gas

- Petrochemicals

- Ports

- Power

- Press Information Bureau-Government of India

- Press Release

- Press Release: Quanzhou Delegation Explores Business Collaboration in India

- Renewable Energy

- Tourism & Hospitality

- Uncategorized

- Women Empowerment

Archives

- March 2024

- January 2024

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- September 2020

- August 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- August 2019

- July 2019

- May 2019

- April 2019

- March 2019

- July 2018

- June 2018

- April 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014